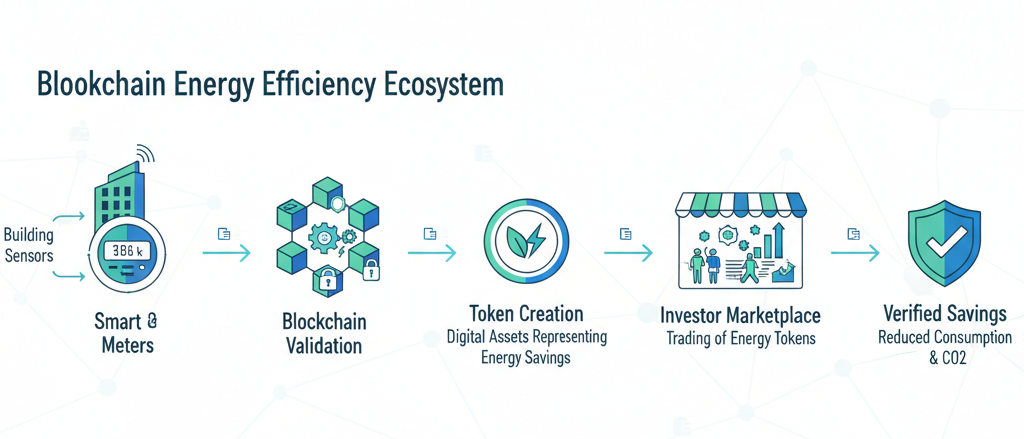

The convergence of blockchain technology and building energy systems represents one of the most transformative developments in sustainable infrastructure. While traditional energy efficiency investments have long struggled with verification challenges, opaque financial structures, and limited accessibility for small-scale investors, blockchain tokenization is dismantling these barriers with unprecedented precision. This technological revolution promises to reshape how we fund, manage, and validate energy-saving initiatives across commercial and residential buildings worldwide.

What Fundamental Problem Does Blockchain Tokenization Solve in Energy Efficiency?

Traditional building energy efficiency projects face a persistent credibility gap. When a building owner claims to have reduced energy consumption by 30% through retrofits, how can investors verify this claim? How do we prevent double-counting of savings? How can smaller investors participate in multi-million dollar efficiency projects? These questions have plagued the sector for decades, limiting capital flow into desperately needed infrastructure improvements.

Blockchain tokenization addresses these challenges through three revolutionary mechanisms. First, it creates tamper-proof digital ledgers that record every kilowatt-hour saved with cryptographic certainty. The Chiang Mai University project in Thailand demonstrates this transparency, tracking carbon intensity in real-time across 142 buildings while facilitating energy trading through blockchain validation Powering the Energy Sector through Blockchain | California Management Review. Second, tokenization enables fractional ownership of energy assets, allowing individual investors to own shares of solar installations or efficiency upgrades worth mere hundreds of dollars rather than requiring institutional capital. Third, smart contracts automate verification and payment distribution, eliminating intermediaries who historically consumed 15-20% of project value through administrative overhead.

The global blockchain-in-energy market reached $3.1 billion in 2024 and analysts project explosive growth to $90.8 billion by 2034—a compound annual growth rate of 41.6%. This expansion reflects fundamental structural shifts including growing demand for decentralized renewable energy, global mandates requiring transparent emissions tracking, and the maturation of smart contract and grid automation technologies Blockchain and the Energy Sector in 2025: From Disruption to Infrastructure and why we need to start paying attention… - WattCrop.

How Do Smart Contracts Automate Energy Trading and Verification?

Smart contracts function as self-executing agreements with terms written directly into code that runs on blockchain networks. In building energy systems, these contracts transform manual, error-prone processes into automated, trustless transactions that execute within milliseconds of predefined conditions being met.

Consider a practical example: a commercial building installs LED lighting and new HVAC controls promising 25% energy reduction. Traditional verification requires months of utility bill analysis, disputed baseline calculations, and expensive third-party auditors. Smart contracts revolutionize this process by connecting directly to building management systems and smart meters. Research demonstrates that smart contract-driven automated trading models outperform traditional approaches by increasing market efficiency, lowering transaction costs, and reducing price fluctuations Optimizing power system trading processes using smart contract algorithms | Energy Informatics | Full Text.

The automation cascade works as follows: Building sensors measure actual consumption every 15 minutes. This data flows to blockchain nodes where smart contracts compare real consumption against baseline predictions. When savings exceed thresholds, the contract automatically triggers payment distribution to investors, building owners, and service providers—all within 0.5 seconds compared to the 95% slower traditional billing systems. This processing speed eliminates waiting periods that historically slowed market liquidity while removing manual intervention risks How Blockchain Powers Energy Trading: Real Results from Top Energy Companies.

PowerLedger, the world's leading blockchain energy platform, exemplifies this automation at scale. Operating on the Solana blockchain to leverage 50,000 transactions per second processing capacity, PowerLedger has facilitated over 1.67 gigawatt-hours of energy trading as of 2024, with active projects across Europe, Asia, and Australia Powering the Energy Sector through Blockchain | California Management Review. The platform's migration from Ethereum to Solana demonstrates the critical importance of selecting appropriate blockchain infrastructure—Proof-of-Stake networks consume dramatically less energy than older Proof-of-Work systems.

Why Does Proof-of-Stake Matter for Sustainable Energy Applications?

The environmental credentials of blockchain technology itself determine whether it can legitimately claim to advance sustainability. This question sparked intense debate as early blockchain implementations consumed staggering amounts of electricity.

Proof-of-Work (PoW) consensus mechanisms, used by Bitcoin, require miners to solve complex mathematical puzzles using massive computational power. Bitcoin mining consumes more annual energy than Kazakhstan and approaches Netherlands-level consumption, with each transaction consuming approximately 830 kilowatt-hours Explained: Proof-of-Work vs. Proof-of-Stake Carbon Footprint. This energy intensity became untenable for applications claiming environmental benefits.

Proof-of-Stake (PoS) fundamentally reimagines blockchain validation. Rather than computational races, PoS selects validators based on cryptocurrency holdings they "stake" as collateral. Ethereum's transition to PoS achieved a stunning 99.992% reduction in energy consumption, while platforms like Algorand consume just 0.000008 kilowatt-hours per transaction compared to Bitcoin's 830 kilowatt-hours Staking in Crypto: How PoS Reduces Energy Consumption - BlockApps Inc.. This efficiency gain makes PoS suitable for high-frequency energy trading applications where thousands of micro-transactions occur daily.

The Crypto Carbon Rating Institute provides concrete numbers: annual electricity consumption for PoS networks ranges from 70 megawatt-hours for Polkadot to 1,967 megawatt-hours for Solana, resulting in carbon footprints between 33 and 934 tonnes of CO2 annually Explained: Proof-of-Work vs. Proof-of-Stake Carbon Footprint. These two networks collectively consume energy equivalent to merely 200 US households—negligible compared to the energy savings they enable through optimized building operations.

How Does Tokenization Enable Micro-Investment in Energy Efficiency?

Traditional energy efficiency financing requires either institutional investors writing seven-figure checks or complex aggregation schemes that still exclude individual participants. Tokenization shatters these barriers by converting physical energy assets into divisible digital tokens traded on blockchain platforms.

The mechanics work elegantly: a building owner planning a $2 million retrofit creates 2,000,000 digital tokens, each representing $1 of project value and a proportional claim on future energy savings. Italy's Enel, the world's largest private electricity distribution company, pioneered this approach in January 2025, launching Europe's first Markets in Crypto-Assets Regulation (MiCA) compliant energy utility token enabling fractional ownership of solar panels and wind farms Enel: Tokenizing renewable energy assets on Algorand. Italian residents can now invest as little as €100 in renewable energy infrastructure, receiving returns based on actual electricity production.

This democratization extends beyond simple investment access. Tokenized assets enjoy enhanced liquidity—investors can sell tokens on secondary markets rather than waiting years for project completion. Digital tokens can be easily bought or sold, offering flexibility and agility in managing investment portfolios, with this liquidity particularly attractive for assets requiring quick conversion The Rise of Tokenization in Renewable Energy Investments - Aurora Blog. For building owners, tokenization accelerates capital access, enabling faster project deployment without traditional financing delays.

COMPARISON TABLE: Traditional vs Blockchain Energy Efficiency Financing

| Aspect | Traditional Approach | Blockchain Tokenization |

|---|---|---|

| Minimum Investment | $50,000-$500,000 | $50-$500 |

| Verification Time | 60-90 days (manual audits) | Real-time (automated) |

| Transaction Costs | 15-20% of project value | 0.1-2% of project value |

| Liquidity | Locked until project maturity (5-10 years) | Secondary market trading anytime |

| Transparency | Limited (periodic reports) | Complete (immutable ledger) |

| Geographic Access | Regional institutional investors | Global retail and institutional investors |

| Savings Verification | Disputed baselines, manual calculation | Smart meter integration, cryptographic proof |

| Payment Distribution | Quarterly/annual (manual processing) | Automatic upon milestone achievement |

What Do Real-World Implementations Reveal About This Technology?

Case studies from three continents demonstrate blockchain energy systems moving from pilot projects to commercial deployment, each revealing distinct implementation insights.

CASE STUDY IMAGE: Chiang Mai University smart campus aerial view with solar panel coverage highlighted

Thailand: Chiang Mai University Smart Campus

Chiang Mai University partnered with PowerLedger, BCPG renewable energy, and Thai Digital Energy Development to implement peer-to-peer trading across 142 buildings with 15 megawatts of solar capacity TDED, Thailand - Powerledger. The project prioritizes maximum renewable energy consumption for specific university buildings while allowing surplus energy trading among participants. The implementation achieved 30% renewable energy autonomy with 12 MW of solar capacity and 1.2 megawatt-hours of battery storage.

The financial model proves compelling: solar system owners receive better returns than standard feed-in tariffs, while energy purchasers pay less than grid rates. Billing integration seamlessly incorporates peer-to-peer trades into utility invoicing systems, appearing directly on final statements TDED, Thailand - Powerledger. This integration demonstrates that blockchain systems need not replace existing infrastructure—they enhance it.

Singapore: Blockchain-Enabled Local Energy Markets

Singapore's Energy Market Authority set a 200-megawatt energy storage deployment target by 2025, supported by blockchain trading platforms improving transparency and economic viability. The national Intelligent Energy System and PacificLight grid enable real-time electricity pricing and exchange, with Senoko Energy's peer-to-peer trial demonstrating how urban residents can achieve energy autonomy Blockchain and the Energy Sector in 2025: From Disruption to Infrastructure and why we need to start paying attention… - WattCrop. Singapore's approach emphasizes regulatory integration—blockchain applications must comply with stringent financial services frameworks while delivering measurable grid stability benefits.

Dubai: Blockchain Strategy for Smart City Infrastructure

Dubai's government established a mandate to become the first blockchain-powered city, targeting implementation of blockchain in 100% of applicable government services including energy, real estate, and medical sectors Blockchain Case Study for Government in the UAE. The Smart Dubai Office partnered with ConsenSys to analyze core infrastructure needs, resulting in creation of a Blockchain Platform as a Service blueprint enabling government entities to prototype solutions using shared frameworks. Dubai's strategy demonstrates how municipal leadership can accelerate blockchain adoption through coordinated infrastructure investment and regulatory clarity.

What Challenges Must the Industry Overcome for Widespread Adoption?

Despite remarkable progress, blockchain energy systems face three critical challenges requiring sustained innovation and policy development.

Regulatory Uncertainty: Energy markets operate under complex, jurisdiction-specific regulations developed long before distributed ledgers existed. Determining whether energy tokens constitute securities, commodities, or utility instruments varies dramatically across countries, creating compliance complexity for platforms operating internationally. The European Union's MiCA framework and Singapore's progressive digital payment token regulations provide templates, but global standardization remains distant.

Scalability Limitations: While Proof-of-Stake dramatically reduced energy consumption, blockchain networks still face throughput constraints. High-frequency building energy applications generating thousands of transactions daily require infrastructure capable of sustained performance without network congestion. Layer-2 solutions and next-generation blockchains address these limitations, but widespread implementation requires continued technical development.

Integration with Legacy Systems: Most buildings operate on decades-old building management systems never designed for blockchain connectivity. Retrofitting smart meters, installing IoT sensors, and establishing secure data pipelines requires significant upfront investment. Successful projects demonstrate integration is achievable, but standardized protocols and reduced hardware costs remain necessary for market-wide adoption.

Looking Forward: The Future of Tokenized Building Energy

Blockchain tokenization represents far more than incremental improvement to existing energy efficiency financing. It fundamentally reimagines how we conceptualize, fund, and verify building performance improvements. By creating transparent, tamper-proof records of energy savings; enabling fractional ownership that democratizes clean energy investment; and automating verification through smart contracts, blockchain technology addresses systemic barriers that have constrained energy efficiency markets for decades.

The confluence of technical maturation—particularly energy-efficient Proof-of-Stake consensus mechanisms—with growing policy support and successful real-world deployments suggests we approach an inflection point. As the global blockchain-in-energy market expands toward projected $90 billion valuation by 2034, building owners, investors, policymakers, and technology providers who understand these systems will shape the built environment's transition to genuine sustainability.

The question facing real estate and energy executives is no longer whether blockchain will transform building energy efficiency, but rather how quickly they can position their organizations to participate in this revolution. Those who act decisively today will not merely witness this transformation—they will drive it.